¡Hello and welcome! We’ll teach you how to boost your CIBC credit card limit in a few simple steps. To spend more freely, you will most likely need to increase your CIBC credit card limit. At the end of this piece, we will lead you through the method and offer some information regarding this limit.

How to Increase CIBC Credit Card Limits

To apply for a credit boost on your CIBC card, please follow the procedures below:

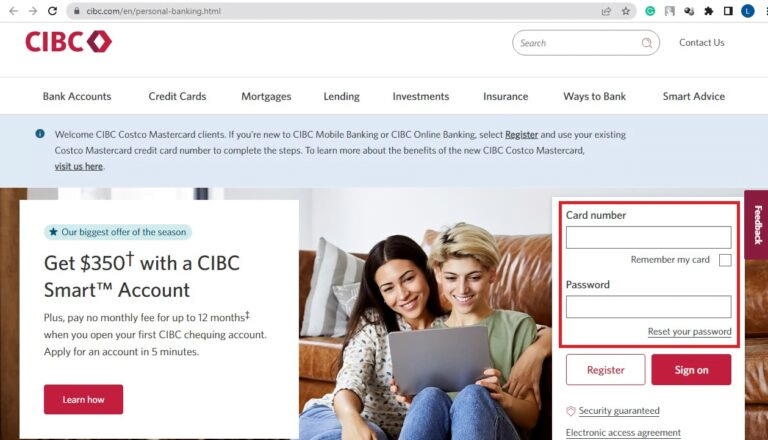

- Go either to the CIBC Online Banking website or the Mobile Banking app.

- Sign in to your account to begin the process.

- Select “Customer Services” from the drop-down list.

- Select “Apply for a credit limit increase” and follow the steps on the page.

- It’s as simple as that! You must wait a few days for confirmation. When you gain approval, the necessary amount will be applied immediately.

You may always contact a CIBC representative if you have any difficulty seeking the expansion. They give a customer support hotline for those who want to request over the phone. To do so, call 1-800-465-4653 and ask for a credit limit increase; they will lead you through the procedure.

Eligibility for a CIBC Credit Card Limit Increase

When you initially get a credit card, the bank decides your credit limit mostly based on your credit history. In other words, your income, debts you have and have not paid, and credit score are all factors in establishing your CIBC credit card limit.

The truth is that the bank likes clients who can make timely credit card payments. As a result, if you pay on time and in full, you will almost certainly obtain a high limit. If you have outstanding debts on your credit history, you will receive a limited credit limit.

To apply for a raise, however, you must first complete the following requirements:

- The primary cardholder must be the applicant.

- Your credit card has been in use for at least 6 months.

- You have not accepted a credit limit increase offer in the last six months.

- You had a strong track record of paying bills on time (at least the minimum amount each month before the invoices were due).

- Of course, your credit card account must be in good standing.

Is it risky to request a credit limit increase on my CIBC credit card?

It is always contingent on how you want to apply the new constraint. It can in handy in an emergency, such as when paying for medical expenses. In such a case, you’ll have piece of mind knowing you have enough credit available for unforeseen needs.

Having a greater limit, on the other hand, suggests that you may overspend at some point. Keep in mind that if you over your limit, you will be required to pay your expenditures plus interest. This might hurt your credit score and make it harder to receive additional services.

We strongly advise you to use your credit card responsibly, not exceeding half of the available credit. You can, however, request a decrease in your CIBC credit card limit at any time. You will have less money to spend, but more possibilities to pay off your debts.