PDF of the Central Bank of India’s NEFT/RTGS form Account holders at CBI Bank have the option of using the RTGS/NEFT service online, offline, or both by visiting a branch or using net or mobile banking.

Real Time Gross Settlement (RTGS) and National Electronic Funds Transfer (NEFT) are electronic payment methods that make it simple for people to move money between banks or between people. NEFT mode fund transfers are settled in batches as compared to RTGS mode’s real-time settlement method.

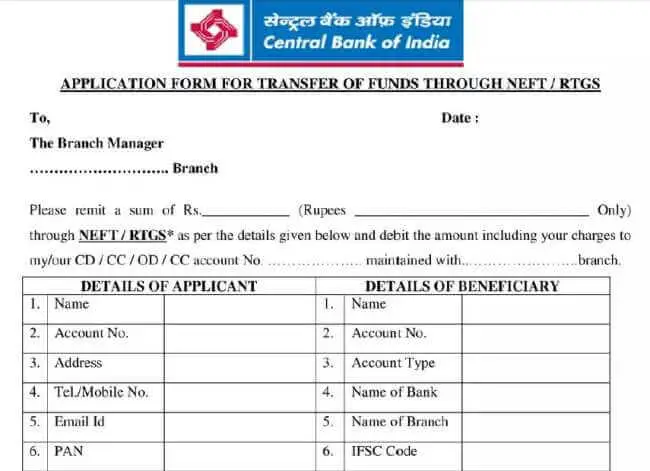

NEFT/RTGS Form of CBI Bank

RTGS is typically used for large-scale transfers. The minimum and maximum amounts that can be transferred via RTGS are both Rs. 2 Lakhs. There is no minimum or maximum amount with NEFT, though.

Using internet or mobile banking, one can transfer money at any time, anywhere. To use the offline service, you must go to the bank’s branch location and fill out an application for NEFT/RTGS to handle the transaction. The form is available for download online or via banks. Visit the bank’s official website to obtain the form, or use the link we’ve supplied.

Download CBI RTGS form / NEFT Form,

You can access a direct download link for the Central Bank of India’s CBI NEFT/RTGS Form here. By just clicking on the link provided below, you can quickly obtain the application form.

Central Bank of India- CBI NEFT/RTGS Form PDF

- Article Name: CBI NEFT/RTGS Form PDF

- Department: Banking and Finance

- Beneficiary: Bank’s Customers

- Language: English

- Official Website: https://www.centralbankofindia.co.in/

- PDF Form Download: Central Bank of India- CBI NEFT/RTGS Form PDF Download

How to Complete an Offline NEFT/RTGS Form for the Central Bank of India

To fill the form without any trouble, you need to follow the given below steps:

- As you will download & open the form, you will note there are three heads in the CBI NEFT/RTGS form. The first heading is for Applicant/Remitter Information, the second is for Beneficiary Details, and the last heading is for Bank’s Use Only.

- Now enter the branch name, the amount to be sent (in words and figures), and the account number to be debited along with the branch in the form.

- Provide information for the remitter column, including the remitter’s name, account number, address, mobile number, email address, and PAN number.

- Now enter the beneficiary’s information, including their name, account number, account type, beneficiary bank and branch information, and IFSC code.

- Verify all of the information on the form before signing and delivering it to bank representatives.

- To process the transaction, bank representatives must validate and sign in the “For Bank’s Use Only” field. As seen in the image below, information such as the Transaction Ref. No. or UTR No. is mentioned here.