ICICI Bank offers its credit card holders the option of internet banking to make it simpler for them to manage their credit card balances. Access to a variety of online services is provided through credit card internet banking. These consist of checking account details such as the card’s credit or cash limit, transaction information, payment deadlines, and monthly bills, among others.

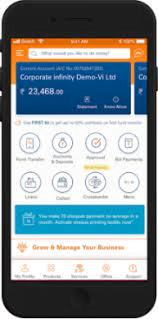

ICICI Net Banking

Customers who have registered for online banking can also submit a number of requests pertaining to credit cards. These requests may include requesting a credit card loan, increasing the credit card limit, redeeming reward points, etc. Customers of ICICI Credit Card Online Banking benefit from substantial time and energy savings as well as secure, contactless banking.

How to Sign Up for Internet Banking with an ICICI Bank Credit Card

The decision to use ICICI credit card online banking is simple and involves just two steps:

Customers of ICICI Bank Who Have Nett Banking Currently:

- Credit cards may be easily linked to an account by account users who already use ICICI Nett Banking.

- Visit the website for ICICI Internet Banking. https://infinity.icicibank.com/corp/Login.jsp

- Enter your user name and password to access your account.

- Under “Customer Service,” choose “Service Requests.”

- ‘Link my Credit Card Account to my User ID’ is the option you want to select under ‘Credit Card’ when you scroll down the page.

- On the next page, enter the information. Information such as a credit card number, expiration date, cellphone number, and email address. The ICICI savings account will automatically be filled out. Choosing which account to link with is an option for customers who have several accounts.

- Before clicking “Submit,” carefully read the terms and conditions.

- It will then display a confirmation page. The registered mobile number will get an OTP.

- As confirmation, enter the OTP.

- Along with the service request number, a confirmation message will show up on the screen.

- You can follow the status of the application by writing down the number.

- It will take one working day to begin processing the request to link the credit card to internet banking.

- A message is sent once the credit card is linked and is made active in the online account.

Customers of ICICI Bank currently without a net banking account:

Account holders with ICICI Bank must first sign up for online banking if they don’t already have it. You can carry out this action online, in person at a bank branch, or even by phone banking.

New users of ICICI Bank credit cards

Customers must create a User ID and Password in order to use ICICI Credit Card internet banking. The steps listed below must be followed in order to manufacture the identical one:

How to Create a Net Banking User ID for an ICICI Credit Card

- Contact the ICICI Bank Customer Care line.

- To accept credit cards, choose “Option 2”.

- Enter the 4-digit PIN and 16-digit credit card number.

- The Interactive Voice Response Service (IVRS) will provide the credit card balance information. Go with “Self-Banking” “Option 1.”

- To receive a User ID, choose “Option 1.”

- Choose “Option 3” to reset the User ID if the consumer wants to alter it.

Procedures for Creating an ICICI Nett Banking Password

To create a password, follow the instructions provided:

- Visit the website for ICICI Internet Banking. https://infinity.icicibank.com/corp/Login.jsp

- Select ‘Get Password’ under the ‘May I assist you’ heading.

- Go to the ‘Generate Password Online’ page.

- Enter your User ID and then click “Go.”

- Type in your registered mobile number and press “Go.”

- The registered number is then provided a special number. Use the same number again.

- A new password will be generated following the verification of all the information.

- To access nett banking, enter your User ID and Password.

Making requests with an ICICI credit card’s nett banking account

- Requests pertaining to statements may be made by going to “My Account>Credit Card>Service Request.” One can submit requests for ICICI credit card statements. This includes the physical statement’s activation or deactivation, requests to receive credit card statements by email or postal mail, etc.

- This includes the physical statement’s activation or deactivation, requests for credit card statements to be sent by email or postal mail, etc.

- Requests for the adjustment of account details may be made by going to “My Accounts>Credit Cards>Alert subscription>Submit.” Changes to personal and account information are possible through ICICI Internet Banking. This contains address, the ability to create a PIN for a credit card, the ability to cancel a credit card, etc.

- Redeem reward points by signing into your account to view your points balance and redeem them. Visit ‘My Accounts>Credit Cards>Reward Points>Redeem Online’ to redeem your points. Choose from a selection of alternatives that will be presented to you for redemption, then click “Submit.”

- Request for credit card blocking: block the card through online banking if it has been lost or stolen. ‘My Accounts>Credit Cards>Block your Credit card – Instant deactivation’ should be accessed. Select the credit card number, then block it.

- In the event that a credit card is reissued and either cannot be delivered or must be returned, a replacement credit card will be sent out. Through online banking, go to “My Accounts>Credit Cards>Service request > Re-dispatch request for an undelivered card” to seek the despatch of the said item.

- Transform transactions above Rs. 3000 made with a credit card into EMIs within 30 days of the purchase date. Select the “My Accounts>Credit Cards>Convert to EMI” option.